June 2025 Market Commentary

Despite Volatility, Equities Post Gains in First Half of 2025

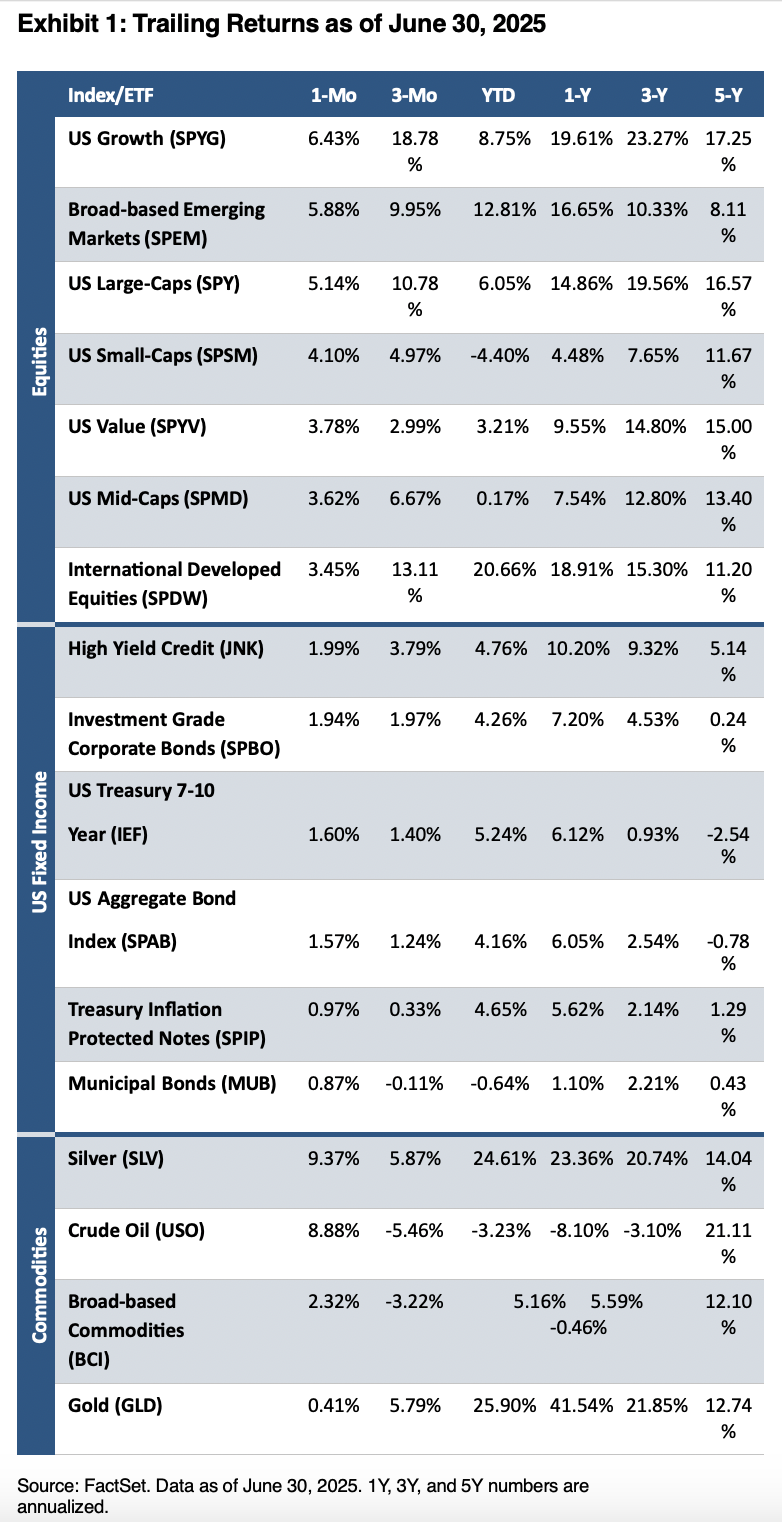

Despite tariff concerns, geopolitical risks, and inflation worries, equity markets posted positive returns in the first half of the year amid decreasing policy uncertainty, strong earnings, and a resilient—although slowing—economy. The S&P 500 Index recovered dramatically within the period, rebounding over 20% since the April 8th tariff-related lows. International developed equities (+20.7%) were the best performers, followed by emerging market equites (+12.8%) and US growth (+8.8%). Bonds mostly fared well as 7–10-year US Treasuries gained 5.2%, high yield credits rose 4.8%, and Treasury Inflation Protected Notes were up 4.7%. Aside from crude oil (-3.2%), commodities posted positive returns as gold increased 25.9%, silver was up 24.6%, and broad-based commodities rose 5.2%.

Fed Continues to Hold Rates Steady Amid Uncertain Outlook

The Federal Reserve held interest rates steady at the June FOMC meeting, maintaining the fed funds rate in the 4.25–4.50% range. Chair Powell reiterated that the current stance of monetary policy leaves the Committee well positioned to respond to economic developments as they unfold. Inflation has eased significantly from its 2022 high but remains somewhat elevated, with the Core Personal Consumption Expenditures (PCE) index holding at 2.7% in May. Q1 GDP was reported to have edged down from -0.2% to -0.5%, though private domestic final purchases, a preferred measure of underlying demand, grew at a solid 2.5% pace. Policymakers remain focused on risks tied to tariffs, which are expected to put upward pressure on prices in the coming months, though the ultimate size and duration of these effects remain uncertain. Market participants broadly anticipate the federal funds rate to remain unchanged until the September FOMC meeting.

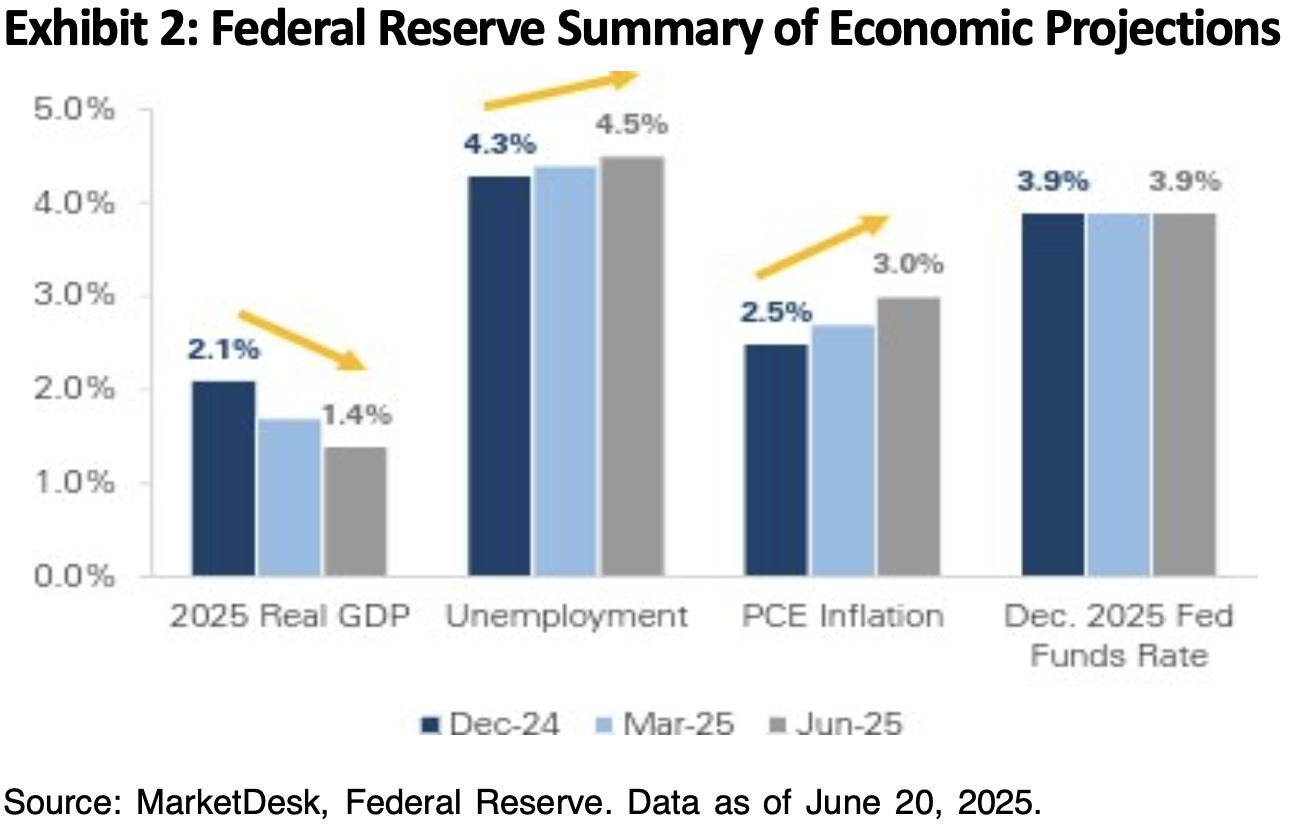

Growth Forecasted to Decrease, Inflation & Unemployment to Rise

The Fed’s updated Summary of Economic Projections revealed that compared to March 2025, forecasts for real GDP have been revised down while both unemployment and inflation expectations have increased. However, the December 2025 projected fed funds rate remains unchanged at 3.9%, suggesting approximately two 25bps rate cuts by year end.

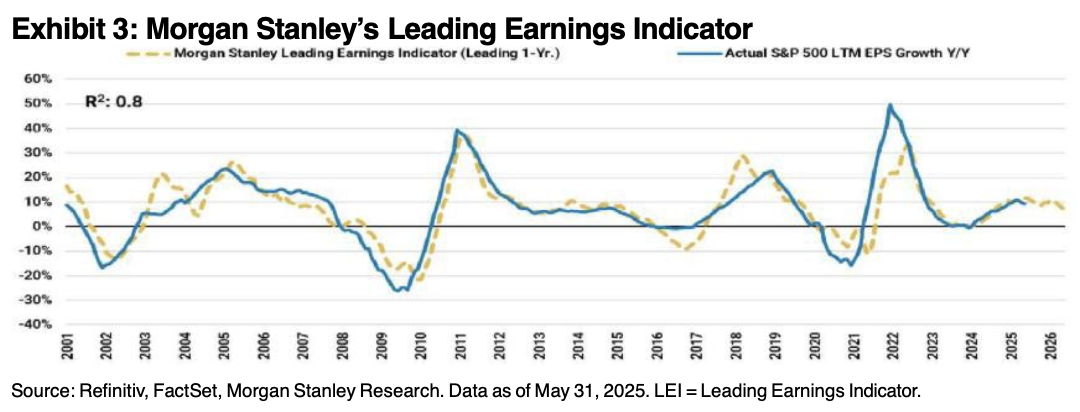

Earnings Revision Breadth Recovery Points to Growth Ahead

Morgan Stanley’s LEI estimates almost 10% EPS growth for the S&P 500 over the next year given the V-shaped recovery in earnings revision breadth, which is likely due to peak policy/tariff uncertainty, a weaker dollar, and a bottoming in AI-capex growth expectations.

Declining Dollar: A Catalyst for Risk Assets?

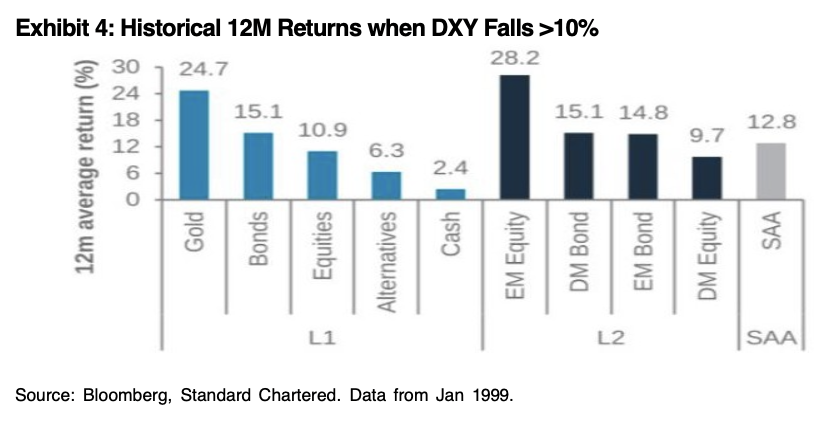

Historically, when the US Dollar Index (DXY) declines by more than 10%, risk assets like gold, bonds, and equities tend to deliver strong returns in the 12 months ahead.

Why Diversification is Winning in 2025

2025 is proving to be the year that vindicates disciplined, diversified, and contrarian investing. A multi-asset 60/40 portfolio that tilts to overseas markets, real assets, and is diversified across US fixed income markets is outperforming the S&P 500, based on our measure (past performance is not indicative of future results). Part of the outperformance can be attributed to tilting away from overvalued, over-concentrated exposures.

For years, the market has been dominated by a handful of names. But portfolios built around owning the S&P 500, Nasdaq 100, or the "Magnificent 7" plus T-bills are not largely diversified. The S&P 500 now has over 30% of its weight in seven stocks. That’s not just concentration risk, it’s a potential vulnerability if market leadership broadens or falters.

Instead, our portfolios emphasize 1) Non-US equities with improving fundamentals and attractive valuations, 2) commodities/real assets as a hedge against inflation and USD weakness, and 3) international FX exposures to diversify away from the dollar's increasingly challenged status. Moreover, here are several important macro signals we're tracking:

- Less Rate Cuts than Priced: With inflation still elevated, lower but stable expected GDP, and a contained labor market, the Fed may remain on pause.

- Higher Long-End Rates: This is helping the Fed’s tightening efforts, reducing the need for near-term policy action.

- Policy Risk has Stabilized: Much of the negative policy news (immigration, tariffs) appears to have bottomed. The Israel-Iran situation is a known known—unlike trade wars, we don’t believe it poses systemic risk to the market.

- H2 Policy Tailwinds: We expect policy to turn more supportive in the second half—think tax cuts and deregulation.

- Weaker USD as a Tailwind: The dollar has now become a positive driver for multinational earnings.

*SOURCES: BEA, Census Bureau, FactSet, J.P. Astoria Portfolio Advisors, LLC. U.S. Department of Labor. J.P. Morgan Economic Research, Standard & Poor’s, BEA, BLS, Federal Reserve, Standard & Poor’s, MSCI, JPMorgan Credit Research, YCharts, Bloomberg and FactSet, Aptus Capital Advisors. Data are as of June 30, 2025.